Commodity futures trading is a type of financial trading that involves buying and selling contracts for the future delivery of physical commodities such as gold, silver, coffee, wheat, and crude oil. These contracts are traded on exchanges, and they allow investors to speculate on the price movements of commodities and hedge against price fluctuations.

In this article, we will provide you with a comprehensive guide on the commodity futures market: what it is, how it works, who are the players in the market, the pros and cons of trading in this market, and tips on how to make profits in commodity futures trading.

What Is Commodity Futures Market?

The commodity futures market is a global marketplace where traders buy and sell contracts for the future delivery of physical commodities such as agricultural products, metals, and energy products. These contracts are standardized agreements between buyers and sellers that specify the quantity, quality, and delivery date of the commodity. The price of these contracts is determined by the supply and demand of the underlying commodity as well as other economic and geopolitical factors.

How Does Commodity Futures Market Work?

The commodity futures market works through a process of price discovery, whereby buyers and sellers negotiate the price of the contract based on their expectations of the future price of the underlying commodity. Once a buyer and seller agree on a price, they enter into a contract that specifies the terms of the trade, including the quantity, quality, and delivery date of the commodity.

These contracts are traded on exchanges, which act as intermediaries between buyers and sellers. The two most prominent commodity futures exchanges are the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX). These exchanges offer a platform for traders to buy and sell futures contracts, and they also provide information on market trends, news, and data that can help traders make informed trading decisions.

Who Are the Players in Commodity Futures Market?

The commodity futures market includes a variety of players, including commercial users, speculators, and hedgers. Commercial users are companies that use commodities as part of their business operations, such as airlines, food processors, and oil refineries. These companies use futures contracts to hedge against price fluctuations and ensure a stable supply of the commodity they need.

Speculators, on the other hand, are traders who buy and sell futures contracts with the goal of making a profit from price movements. Speculators do not have any interest in taking physical delivery of the commodity; instead, they are interested in profiting from the difference between the buying and selling price of the contract.

Hedgers are traders who use futures contracts to protect themselves against price fluctuations. For example, a farmer might use a futures contract to lock in a price for their crop before it is even harvested. This way, they can ensure a stable income even if the price of the commodity drops in the future.

Pros and Cons of Trading in Commodity Futures Market

Like any investment, trading in commodity futures market has its pros and cons. Here are some of the key advantages and disadvantages of trading in this market:

Pros:

- High liquidity: The commodity futures market is highly liquid, which means that there are always buyers and sellers available to trade with. This makes it easy to enter and exit trades quickly.

- Diversification: Investing in commodity futures allows investors to diversify their portfolio beyond traditional stocks and bonds. Commodities have a low correlation with other assets, which can help to reduce overall portfolio risk.

- Potential for profits: Trading in commodity futures can be highly profitable if done correctly. The price movements in commodity markets can be significant, which means that there is the potential to make large profits if you make the right trading decisions.

Cons:

- High volatility: The commodity futures market can be highly volatile, which means that prices can fluctuate rapidly and unpredictably. This can make it difficult to manage risk and can result in large losses if a trade goes against you.

- Complex market: The commodity futures market can be complex and difficult to understand, especially for beginners. It requires a deep understanding of market trends, supply and demand factors, geopolitical events, and technical analysis.

- Exposure to manipulation: The commodity futures market has been subject to allegations of market manipulation in the past. This can result in distorted prices and unfair trading practices.

Tips on How to Make Profits in Commodity Futures Trading

If you’re interested in trading in commodity futures, here are some tips that can help you make profits:

- Do your research: Before entering into any trade, make sure you have a good understanding of the underlying commodity, market trends, and other economic factors that could affect the price of the contract.

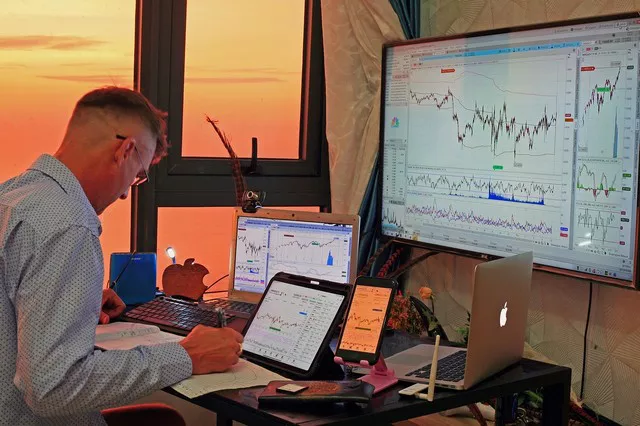

- Use technical analysis: Technical analysis involves using charts and other technical indicators to identify trends and patterns in the market. This can help you make more informed trading decisions.

- Manage risk: Commodity futures trading can be risky, so it’s important to manage your risk carefully. This can involve setting stop-loss orders to limit your losses if a trade goes against you, or diversifying your portfolio to reduce overall risk.

- Be patient: Trading in commodity futures requires patience and discipline. You may need to wait for the right opportunity to present itself before making a trade, and you should always stick to your strategy even if the market conditions change.

Conclusion

The commodity futures market is a complex but potentially lucrative investment opportunity for those who are willing to put in the time and effort to understand it. By understanding how the market works, who the players are, and the pros and cons of trading in this market, you can make informed trading decisions that can help you achieve your financial goals. Remember to always do your research, manage your risk carefully, and be patient, and you could find success in commodity futures trading.