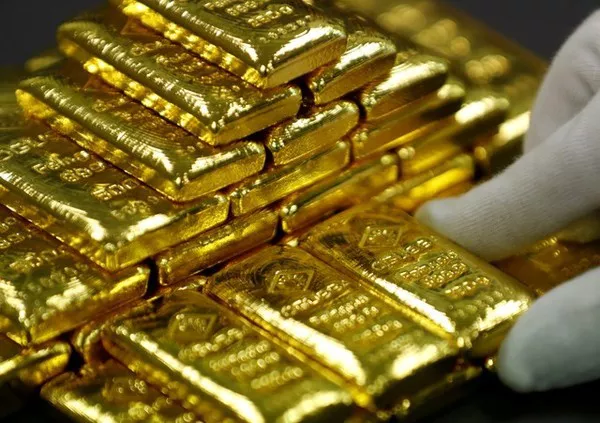

Gold prices saw a slight increase on Thursday as markets remained focused on the potential for a global trade war following U.S. President Donald Trump’s tariff plans. Investors were also awaiting crucial U.S. economic data later in the day, which could impact market sentiment.

As of 0240 GMT, spot gold was up 0.2% at $2,908.50 per ounce, while U.S. gold futures rose 0.3% to $2,936.50. The precious metal reached a record high of $2,942.70 on Tuesday.

Trump’s Tariff Announcement Fuels Trade War Fears

President Trump’s announcement that he would impose reciprocal tariffs on countries charging duties on U.S. imports has intensified concerns over a potential global trade war. This move could also lead to higher U.S. inflation, further driving demand for gold as a safe-haven investment.

“Gold continues to serve as a key diversifier amid trade uncertainties, as market participants seek to mitigate portfolio volatility,” said IG market strategist Yeap Jun Rong.

U.S. Inflation Data Adds Pressure

On the economic front, U.S. consumer prices rose more than expected in January, reinforcing the Federal Reserve’s stance on not rushing to cut interest rates. Federal Reserve Chairman Jerome Powell stated that the central bank’s efforts to control rising prices were not over, signaling that further rate cuts would be postponed until inflation trends back toward the Fed’s 2% target.

With inflation concerns lingering, investors are now turning their attention to the Producer Price Index (PPI) data, set to be released at 1330 GMT. Yeap noted that while the Consumer Price Index (CPI) data exceeded expectations, the upcoming PPI data might have a more muted impact as markets have already priced in a prolonged high-interest-rate environment.

Higher Interest Rates Weigh on Gold’s Appeal

Gold is traditionally seen as a hedge against inflation. However, higher interest rates can reduce the appeal of non-yielding assets like gold. As the Fed signals a more cautious approach to rate cuts, gold’s role in diversifying investment portfolios remains in focus.

Geopolitical Developments: Trump’s Ukraine Talks

In addition to economic factors, geopolitical developments are influencing market sentiment. President Trump has directed U.S. officials to begin discussions aimed at ending the ongoing war in Ukraine, which could have broader implications for global stability and financial markets.

Other Precious Metals

Alongside gold, other precious metals also saw slight gains. Spot silver rose 0.2% to $32.29 per ounce, platinum increased by 0.2% to $994.75, and palladium firmed 0.5% to $978.46.

Conclusion

As the threat of a global trade war escalates and U.S. economic data takes center stage, gold remains a key asset for investors seeking stability amid uncertainty. The interplay between inflation, interest rates, and geopolitical developments will continue to influence gold prices in the coming days.

Related topics: