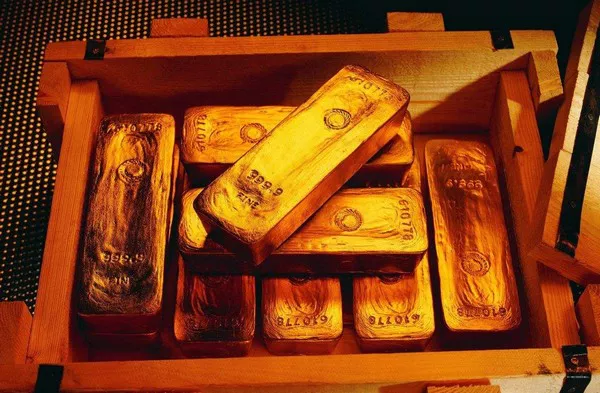

Gold prices slipped on Tuesday as traders took profits following a record-high run earlier in the session. Despite the pullback, the precious metal remained buoyed by concerns over a potential global trade war sparked by U.S. President Donald Trump’s new tariffs.

As of 1:41 p.m. ET (1841 GMT), spot gold was down by 0.1% at $2,904.87 per ounce, after hitting an all-time high of $2,942.70 earlier in the day. U.S. gold futures settled 0.1% lower at $2,932.60 per ounce.

Tariff Fears Fuel Bullion’s Surge

Trump’s decision to raise tariffs on steel and aluminum imports by 25%, without exceptions or exemptions, has stirred fears of a global trade war. The tariffs are part of a strategy to bolster struggling U.S. industries but also risk escalating tensions with major trade partners. This uncertainty has contributed to gold’s surge, as investors seek refuge in bullion, traditionally seen as a safe haven during times of geopolitical tension and economic instability.

Fed’s Interest Rate Outlook in Focus

Traders are awaiting U.S. inflation data on Wednesday, which could offer fresh insights into the Federal Reserve’s interest rate stance. A Reuters poll indicated that the Fed may hold off on further rate cuts until the next quarter, with tariffs potentially fueling inflation and delaying any rate reductions.

Fed Chair Jerome Powell, in his opening remarks at a Senate Banking Committee hearing, reaffirmed the central bank’s “go-slow” approach to interest rate cuts. He noted that while inflation remains above the Fed’s 2% target, the U.S. economy remains strong overall.

Higher inflation could extend the Fed’s rate pause, which could influence gold’s performance. Higher interest rates generally dampen the appeal of non-yielding assets like gold.

A Hedge Against Inflation, but With Risks

Gold is often seen as a hedge against inflation, but rising interest rates make it less attractive to investors. Despite profit-taking in the short term, the uncertainty surrounding trade tariffs could help support gold prices. Some analysts view any dip as a buying opportunity, expecting that bullish sentiment will return.

Other Precious Metals

Other precious metals also experienced losses. Spot silver fell 0.4% to $31.92 per ounce, while platinum dropped 0.8% to $986.03 and palladium declined 0.3% to $980.25. Despite the pullback, these metals, like gold, remain influenced by broader economic and geopolitical factors.

Related topics: