Trading water futures is an emerging financial practice that reflects the growing recognition of water as a valuable and limited resource. As concerns about water scarcity, climate change, and the sustainable management of water resources intensify, water futures have become an intriguing new instrument in the futures markets. This article will explore what trading water futures entails, the factors driving this market, its implications, and how it fits into the broader context of futures trading.

Understanding Water Futures

Water futures are financial contracts that allow traders to buy or sell a specific amount of water at a predetermined price for delivery at a future date. These contracts are similar to other commodity futures contracts, such as those for oil or gold, but they focus on water—a resource that is vital for human survival, agriculture, and industrial processes.

The concept of water futures is designed to address the challenges associated with water scarcity and the need for efficient water management. By creating a financial market for water, it aims to provide a mechanism for pricing, trading, and allocating water resources in a way that reflects their economic value.

Historical Context

Water futures have been a relatively recent addition to the futures markets. The idea began gaining traction in the early 21st century, driven by increasing concerns about water scarcity and the need for innovative solutions to manage this precious resource. The first water futures contracts were introduced in 2017 on the Chicago Mercantile Exchange (CME), marking a significant milestone in the evolution of commodity trading.

How Water Futures Work

Trading water futures involves several key components:

Contract Specifications

Water futures contracts specify the quantity of water, the delivery location, and the delivery date. Unlike other commodities, where delivery typically involves physical transfer of the commodity, water futures contracts often use virtual or financial settlement. This means that traders may not necessarily take physical delivery of water but instead settle their contracts in cash based on the market price.

Pricing Mechanism

The price of water futures is influenced by a variety of factors, including supply and demand dynamics, climate conditions, and regulatory policies. Water futures prices can fluctuate based on regional water availability, usage patterns, and environmental conditions. Traders use these price movements to speculate on future water availability and to hedge against potential risks related to water shortages.

Trading Platforms

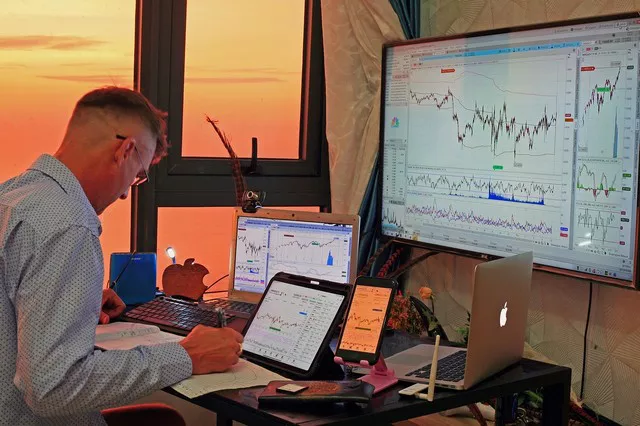

Water futures are traded on futures exchanges, such as the CME, where traders can buy and sell contracts through electronic trading systems. These platforms provide real-time market data, order execution, and settlement services. Traders can participate in water futures markets through brokerage accounts and trading platforms that offer access to these contracts.

Settlement and Delivery

Water futures contracts typically settle financially rather than through physical delivery of water. This means that the difference between the contract price and the spot market price of water at the time of settlement is paid or received. In some cases, contracts may be settled through the transfer of water rights or credits, depending on the specific terms of the contract.

See Also: What Is the Open Interest on Dollar Futures?

Factors Influencing Water Futures

Several factors impact the price and trading activity of water futures:

Water Scarcity

Water scarcity is a significant driver of water futures markets. Regions experiencing droughts or water shortages may see increased demand for water futures as businesses and governments seek to hedge against potential water shortages. Conversely, areas with abundant water supplies may see lower demand for water futures.

Climate Change

Climate change has a profound effect on water resources, influencing precipitation patterns, water availability, and the frequency of extreme weather events. As climate conditions become more variable, the demand for water futures may increase as traders and stakeholders seek to manage the risks associated with changing water availability.

Regulatory Environment

Government policies and regulations play a crucial role in shaping the water futures market. Policies related to water rights, allocation, and pricing can impact the supply and demand for water futures. Additionally, regulations governing the trading and settlement of water futures can influence market dynamics.

Technological Advances

Advances in technology, such as remote sensing and data analytics, have improved the ability to monitor and predict water availability. These technological developments can provide valuable insights into water resource management and influence water futures trading decisions.

Market Sentiment

Like other financial markets, water futures are influenced by market sentiment and speculation. Traders’ perceptions of future water availability, environmental conditions, and regulatory changes can affect their trading strategies and the overall market dynamics.

Benefits of Trading Water Futures

Trading water futures offers several potential benefits:

Risk Management

Water futures provide a tool for managing risks associated with water scarcity and price fluctuations. Businesses and governments can use water futures to hedge against the financial impacts of water shortages, ensuring a more stable supply of this essential resource.

Price Discovery

The water futures market facilitates price discovery by providing a transparent and efficient mechanism for determining the value of water. By reflecting the market’s expectations of future water availability and pricing, water futures contribute to better decision-making and resource allocation.

Incentives for Conservation

The introduction of water futures markets can create incentives for water conservation and efficient usage. By establishing a financial value for water, stakeholders may be more motivated to adopt sustainable practices and invest in technologies that reduce water consumption.

Market Liquidity

Water futures markets can enhance liquidity by providing a platform for trading and investing in water resources. This increased liquidity can attract a diverse range of market participants, including institutional investors, traders, and environmental organizations.

Strategic Planning

Access to water futures markets allows stakeholders to engage in strategic planning and long-term decision-making. By anticipating future water availability and pricing, businesses and governments can develop more effective strategies for managing water resources and addressing potential challenges.

Challenges and Criticisms

While trading water futures offers potential benefits, it also presents several challenges and criticisms:

Market Volatility

Water futures markets can be subject to significant price volatility due to fluctuations in water availability, climate conditions, and regulatory changes. This volatility can create uncertainty and risk for traders and stakeholders, particularly if market prices diverge significantly from actual water conditions.

Ethical Concerns

The commodification of water raises ethical concerns about the impact on vulnerable communities and the environment. Critics argue that trading water futures may prioritize financial interests over the equitable distribution and sustainable management of water resources.

Speculation Risks

The presence of speculative trading in water futures markets can introduce additional risks and distortions. Speculators may drive up prices or create market bubbles, potentially undermining the effectiveness of water futures as a tool for risk management and price discovery.

Regulatory Challenges

The development of water futures markets requires careful regulation to ensure transparency, fairness, and integrity. Regulatory frameworks must address issues related to market manipulation, trading practices, and the protection of water resources.

Access and Equity

Ensuring that water futures markets are accessible and equitable for all stakeholders is a critical challenge. There is a need to balance the interests of various market participants, including small-scale farmers, indigenous communities, and large corporations.

Case Studies and Examples

Several case studies and examples illustrate the use and impact of water futures:

California Water Futures

In California, a region known for its water scarcity issues, water futures have been used to manage water resources and hedge against drought-related risks. The California Water Futures Market allows participants to trade water rights and futures contracts based on the availability of water in the state.

Australia’s Water Market

Australia’s water market, which includes water futures trading, provides insights into the benefits and challenges of trading water as a commodity. The market has been successful in improving water allocation and encouraging conservation but has also faced criticisms related to market volatility and equity.

International Initiatives

Various international initiatives have explored the concept of water futures and their potential applications. These initiatives aim to address global water challenges and promote sustainable water management practices through innovative financial instruments.

Conclusion

Trading water futures represents a novel approach to managing and valuing one of the most essential resources on the planet. By providing a mechanism for pricing, trading, and allocating water, water futures markets offer a potential solution to the challenges of water scarcity and environmental sustainability.

However, the development and implementation of water futures markets must address various challenges and criticisms, including market volatility, ethical concerns, and regulatory issues. As the global demand for water continues to grow and climate conditions evolve, water futures will play an increasingly important role in shaping the future of water resource management.

For traders, businesses, and governments, understanding the dynamics of water futures and their implications is crucial for making informed decisions and navigating the complexities of this emerging market. As the market continues to evolve, ongoing research, regulation, and innovation will be essential in maximizing the benefits and minimizing the risks associated with trading water futures.