Feeder cattle futures trading provides investors with a unique opportunity to participate in the dynamic world of commodities markets. As a subset of cattle futures, feeder cattle futures enable market participants to speculate on the future prices of young, lightweight cattle known as feeders. This article explores the intricacies of trading feeder cattle futures, offering insights into the factors that influence prices, risk management strategies, and the overall dynamics of this specialized corner of the futures market.

Understanding Feeder Cattle Futures

Feeder cattle futures are financial instruments that allow traders to buy or sell a standardized quantity of feeder cattle at a predetermined price on a future date. These contracts are typically traded on commodities exchanges, providing a regulated platform for market participants to engage in feeder cattle futures trading. The primary focus of feeder cattle futures is on young cattle that are raised on pasture and have not yet reached maturity. The underlying asset, feeder cattle, represents a crucial stage in the cattle production process, making these futures contracts essential for both producers and speculators.

Market Fundamentals Influencing Feeder Cattle Futures

Successful trading in feeder cattle futures requires a solid understanding of the market fundamentals that drive prices. Various factors influence the supply and demand dynamics of feeder cattle, ultimately impacting futures prices. Weather conditions, feed costs, and overall economic trends are key determinants. Adverse weather, such as droughts, can limit pasture availability, affecting the supply of feeder cattle. Fluctuations in feed prices, especially for grains like corn and soybeans, also play a significant role, as they impact the cost of raising cattle. Traders must stay attuned to these fundamental factors to make informed decisions in the feeder cattle futures market.

Market Participants in Feeder Cattle Futures

Feeder cattle futures attract a diverse array of market participants, each with distinct motives and strategies. Producers, including ranchers and feedlot operators, often engage in these futures contracts to hedge against potential price fluctuations in feeder cattle. Speculators, on the other hand, seek to profit from anticipated price movements without a direct interest in the physical delivery of cattle. End-users, such as meat processors and retailers, may also participate to manage their exposure to price volatility. The interplay between these different market participants contributes to the overall liquidity and efficiency of the feeder cattle futures market.

See Also: How do I set up a futures account?

Feeder Cattle Futures Contracts: Specifications and Exchanges

To effectively trade feeder cattle futures, it is essential to understand the contract specifications and the exchanges where these contracts are traded. Specifications typically include details such as contract size, tick size, and expiration dates. The Chicago Mercantile Exchange (CME) is a prominent platform for trading feeder cattle futures, offering standardized contracts that facilitate transparent and efficient price discovery. Traders should familiarize themselves with the specific details of feeder cattle futures contracts on the exchange of their choice to navigate the market confidently.

Analyzing Feeder Cattle Futures Prices

Analyzing feeder cattle futures prices involves a combination of technical and fundamental analysis. Technical analysis examines historical price patterns and trading volumes to identify potential trends and entry/exit points. Fundamental analysis, on the other hand, assesses the underlying factors influencing feeder cattle prices, such as supply and demand fundamentals and macroeconomic trends. Traders often use a combination of these approaches to form a comprehensive view of the market and make well-informed trading decisions in feeder cattle futures.

Risk Management Strategies for Feeder Cattle Futures Traders

Feeder cattle futures, like any financial instrument, come with inherent risks. Traders must implement effective risk management strategies to navigate the uncertainties of the market successfully. Stop-loss orders, which automatically trigger a sell order when a predetermined price level is reached, can help limit potential losses. Diversification is another key strategy, spreading risk across different assets to mitigate the impact of adverse price movements. Traders should also stay informed about market developments and be prepared to adjust their positions in response to changing conditions.

Feeder Cattle Futures and Seasonal Patterns

Seasonal patterns play a significant role in the feeder cattle market, influencing both supply and demand. For example, the spring and fall are typically periods of increased demand for feeder cattle as ranchers and feedlot operators look to restock or prepare for the coming winter. Understanding these seasonal patterns can provide traders with valuable insights into potential price movements in feeder cattle futures. Additionally, awareness of the agricultural calendar, including breeding and weaning seasons, can aid in making more informed trading decisions.

The Impact of Macro-Economic Trends on Feeder Cattle Futures

Macro-economic trends, such as interest rates, inflation, and overall economic growth, can have a profound impact on feeder cattle futures prices. Economic indicators often shape investor sentiment and influence trading decisions. For instance, periods of economic growth may boost consumer demand for beef products, positively impacting feeder cattle prices. Conversely, economic downturns may lead to decreased consumer spending on beef, affecting demand for feeder cattle. Traders in feeder cattle futures should keep a close eye on macro-economic trends to anticipate potential market shifts.

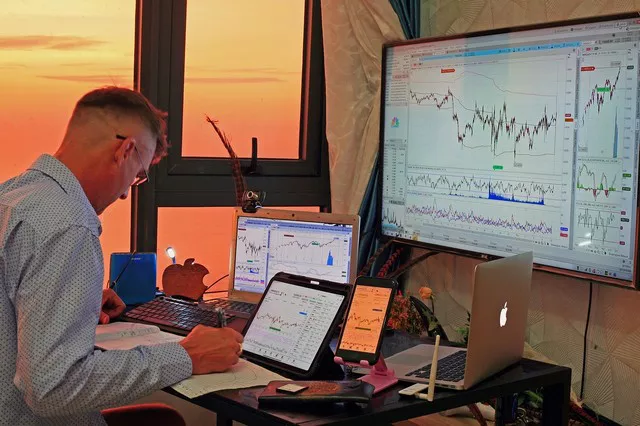

Technology and Automation in Feeder Cattle Futures Trading

Advancements in technology have transformed the landscape of futures trading, including feeder cattle futures. Electronic trading platforms and algorithmic trading systems have become integral to market participation, allowing for faster and more efficient order execution. Automated trading strategies, powered by algorithms, can analyze vast amounts of market data and execute trades with precision. Traders leveraging technology should be mindful of potential challenges, such as system outages or algorithmic errors, and implement risk controls to mitigate these risks effectively.

The Role of Fundamental Reports in Feeder Cattle Futures

Fundamental reports, such as USDA (United States Department of Agriculture) reports, play a pivotal role in shaping feeder cattle futures prices. These reports provide key information on factors like cattle inventory, production forecasts, and feed prices. Traders closely monitor these reports to gauge the health of the cattle market and anticipate potential price movements. Unexpected surprises in USDA reports can lead to sharp market reactions, highlighting the importance of staying informed about scheduled releases and understanding their potential impact on feeder cattle futures.

Managing Leverage in Feeder Cattle Futures Trading

Leverage is a double-edged sword in futures trading, amplifying both potential gains and losses. Traders in feeder cattle futures should approach leverage with caution and implement sound risk management practices. The use of margin allows traders to control larger positions with a smaller upfront investment, but it also increases the risk of significant financial losses. Understanding the implications of leverage and setting appropriate position sizes are essential aspects of responsible trading in feeder cattle futures.

International Considerations in Feeder Cattle Futures Trading

Feeder cattle futures are not isolated from global influences. International factors, such as trade agreements, geopolitical events, and currency fluctuations, can impact the feeder cattle market. For instance, changes in trade policies may affect the export and import of beef products, influencing feeder cattle prices. Traders engaged in feeder cattle futures should be aware of international developments and their potential implications for the broader cattle industry.

Educational Resources for Feeder Cattle Futures Traders

Continued education is vital for success in feeder cattle futures trading. Many exchanges, industry associations, and educational platforms offer resources such as webinars, seminars, and training materials. These resources cover a range of topics, from market analysis techniques to risk management strategies. Engaging with educational initiatives can enhance traders’ understanding of feeder cattle futures and provide valuable insights for navigating the complexities of the market.

Conclusion

In conclusion, trading feeder cattle futures requires a comprehensive understanding of market dynamics, risk management strategies, and the factors influencing prices. From analyzing seasonal patterns and macro-economic trends to leveraging technology and staying informed about fundamental reports, successful traders in feeder cattle futures navigate a multifaceted landscape. By mastering the art of feeder cattle futures trading, participants can harness the potential for profit while managing the inherent risks, contributing to the overall vibrancy and efficiency of the commodities market.